PCI DSS QSA

Ingressum can assist your organisation become PCI DSS Compliant (Payment Card Industry Data Security Standard) if you process, store or transmit credit card payments.

What is PCI DSS ?

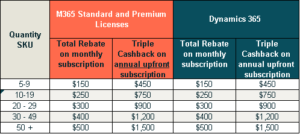

PCI DSS, is jointly released by credit card companies aimed at protecting card holder data. The standard requires the members, merchants, and service providers using credit card facilities to carry out regular PCI Scans and PCI Security Audits after implementing the standard.

PCI DSS Requirements

Requirements of the standard – The PCI DSS version 3.2.1 is comprised of six control objectives that contain one or more requirements. In all there are 12 specific requirements under these control objectives. The verification and reporting process may vary depending on the level of merchants and service providers. An organization is also expected to identify its category or type for identifying what requirements are applicable to it.

ESTABLISH RESPONSE CAPABILITIES

Implementing security mechanisms across process control systems is not a one off exercise. Threats to the security and operation of process control systems develop and evolve over time and organisations should therefore undertake continuous assessment of process control system security.

Ingressum helps organizations meet all the requirements with the help of its robust consulting methodology

Ingressum

Secure the Network

Build and Maintain a secure network: Installing, configuring, and providing guidance on maintaining firewalls, intrusion detection and prevention systems, anti-virus and anti-spyware solutions. Reconfiguring default installations and customizing the setup. Conduct regular internal and external vulnerability assessments

Protect Card Holder Data

Protect Card Holder Data: Identifying the storage, transit channel, transit method, archival and retrieval of credit card data and securing the same. Identifying and implementing the appropriate controls at each data interface and data container

Regular Vulnerability Assessments

Maintain a Vulnerability Management Program: Conduct regular vulnerability identification, assessment and reporting exercises with fix implementation

Strong Access Control

Implement Strong Access Control Measures: Identify all logical and physical access points and ensure the access controls are present as per the requirement of the standard. Ensuring independent and reliable authentication and authorization schemes exist for access control

Regularly test everything

Regularly Monitor and Test Networks: Devise processes to regularly maintain and track network and data access and report any incidents in due time via a risk management procedure

Maintain Security Policies

Maintain an Information Security Policy: Draft and maintain a well-defined information security policy which addresses all the prerequisities of the standard.

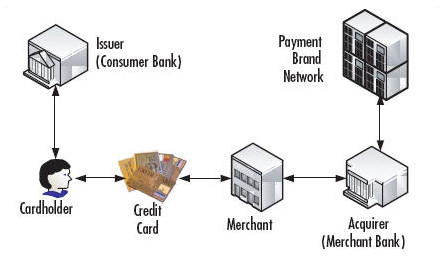

A typical cycle of credit card information touch points is shown in the diagram below:

Get your free trial today!

Protection against cyber threats both visible and those hidden “outside the flags !”